The Ranjan Pai led Manipal Hospitals clinched the deal amongst competition from the Japanese, Chinese and Americans and all of them very large global investors and business groups. Has this set the stage for aggressive growth of Manipal Hospitals, a group known to be risk averse and focused on specific geographies and clinical specialties?

We have dissected the deal and looked at what probably is in store for the combined entity.

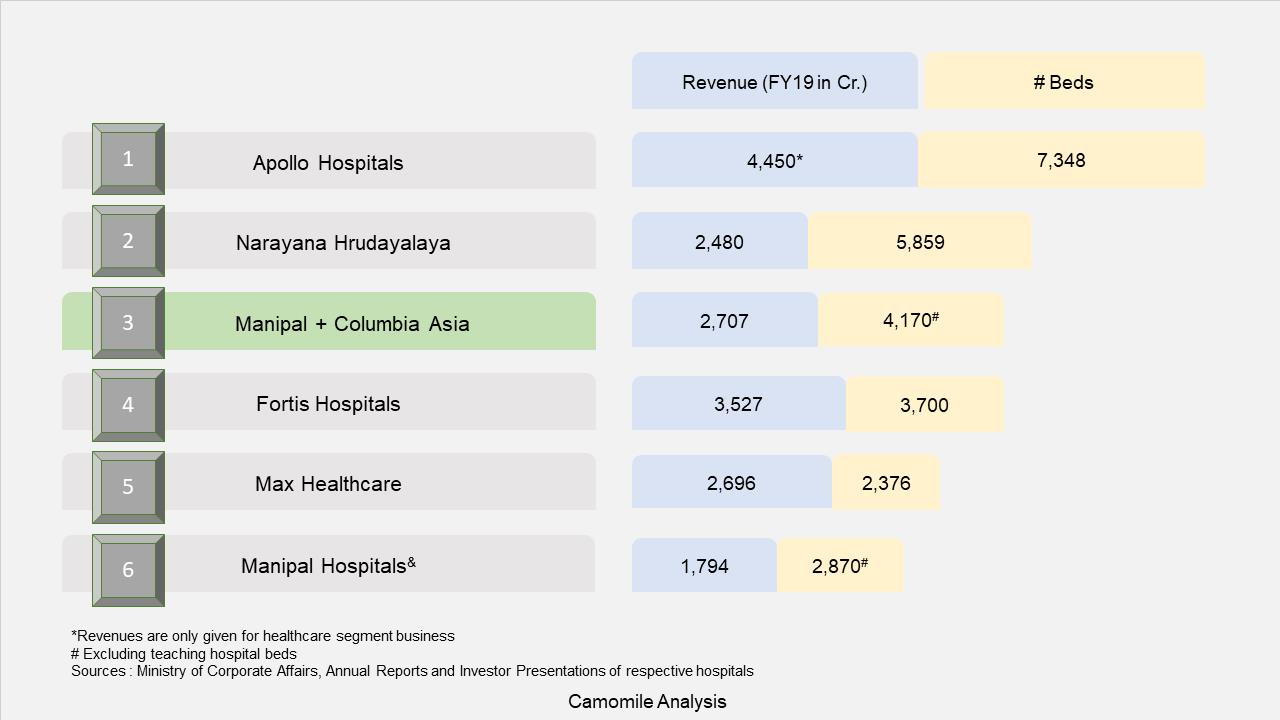

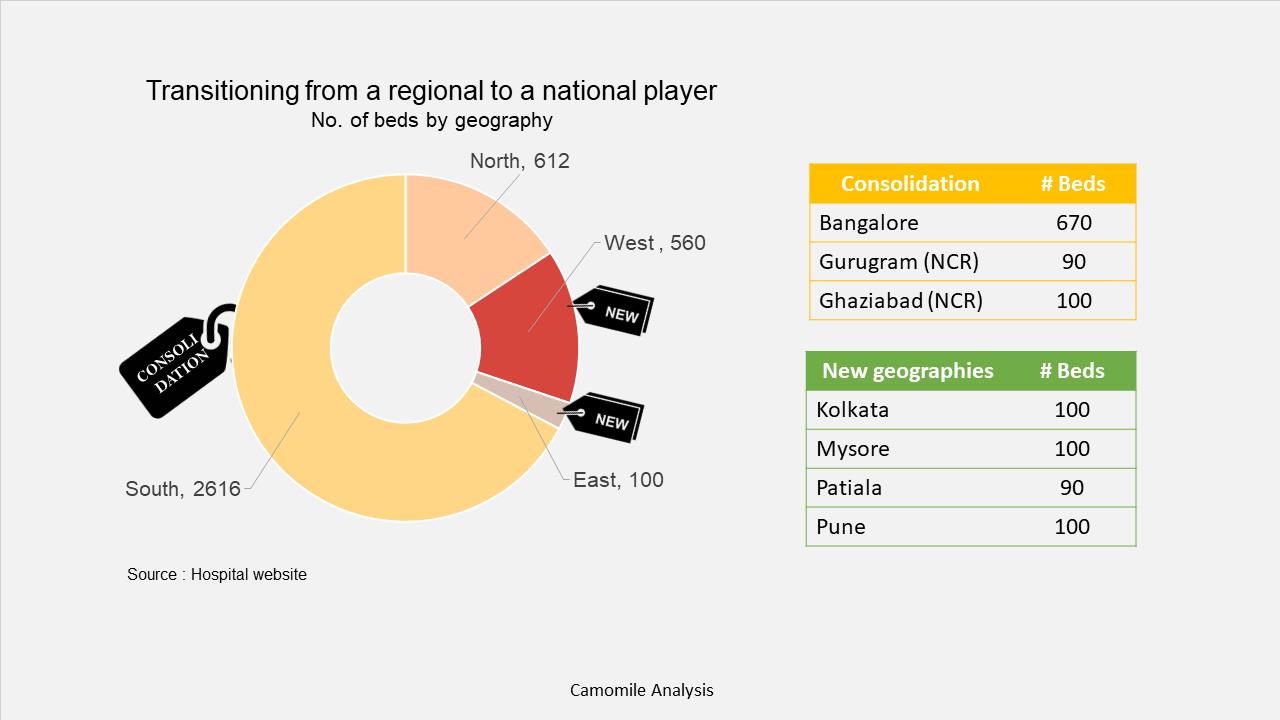

The merged entity shall have 26 facilities across 11 states with 4,000+ operational beds. Manipal Hospitals will become the 3rd largest hospital network in terms of operating beds and the 4th largest in terms of revenues.

Columbia Asia adds Pune (the 2nd fastest growing city in India) to Manipal’s portfolio, providing early entry to an untapped market with very little presence of large players. Pune is also one of India’s top cities by GDP ($69 Billion). Columbia Asia’s facility in Kolkata shall be Manipal’s entry into East India and is expected to open up a completely new market. In addition it strengthens its presence in key markets like Bengaluru, Gurugram and others.

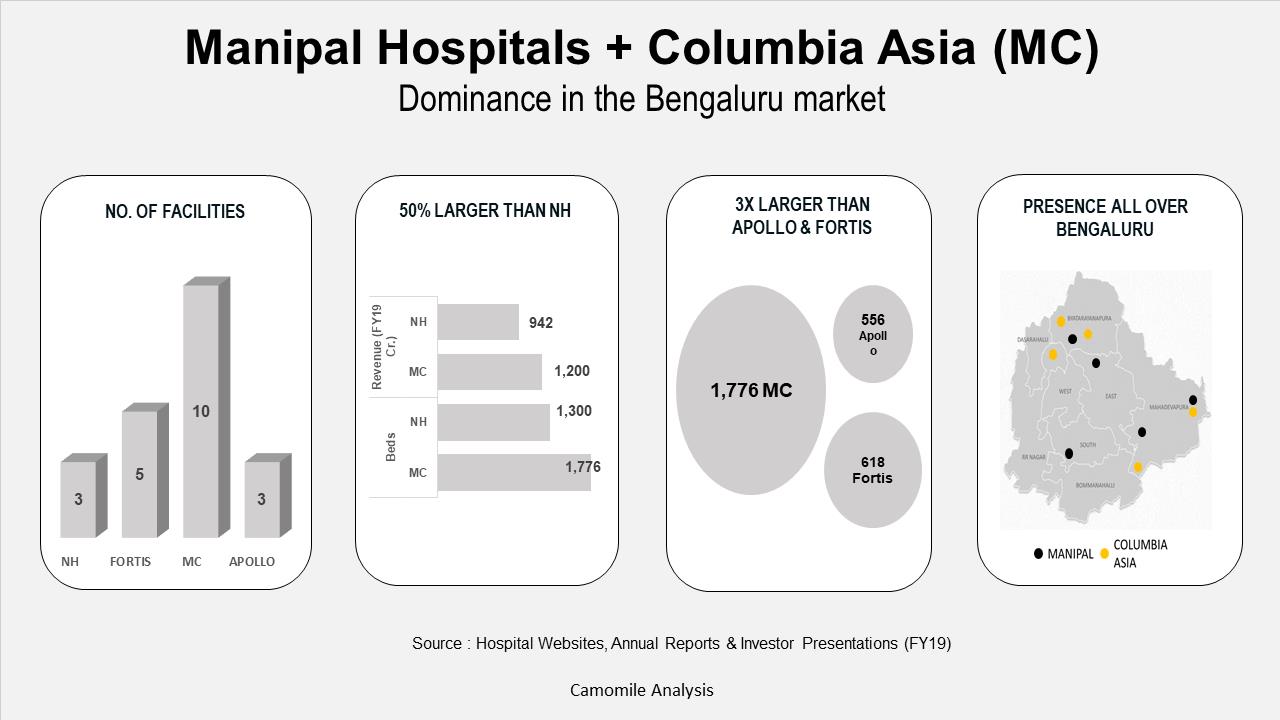

Manipal Hospitals has further consolidated its position in the Bengaluru market and will now have 10 healthcare facilities, covering ~1,800 beds. This is comparable to Apollo Hospitals’ presence in Chennai with 11 facilities and 1,500+ beds and Max Hospitals, NCR with 5 facilities with 1813 beds. Geographic dominance has provided Apollo Hospitals and Max Hospitals higher profitability and market share. Apollo’s concentration on the Chennai market was one of their key growth & profitability drivers. The Chennai cluster ARPOB is ~50% higher than that of their other clusters.

Also, with ~450 beds in two facilities adjacent to each other in Whitefield, the micro market dynamics still remain to be seen. Whitefield is one of the fastest growing regions in Bengaluru, however the two adjacent facilities may have to be strategically replanned to ensure optimal utilisation.

Will this follow suit for Manipal Hospitals is to be seen, especially so in the new normal ?.

The strong digital health wave is breaking boundaries and geographies and will present a significant challenge in enhancing profits by just increasing geographical concentration. Additional complimenting strategies will have to be adopted by the hospital stakeholders, to realize the benefits of increased geographical presence.

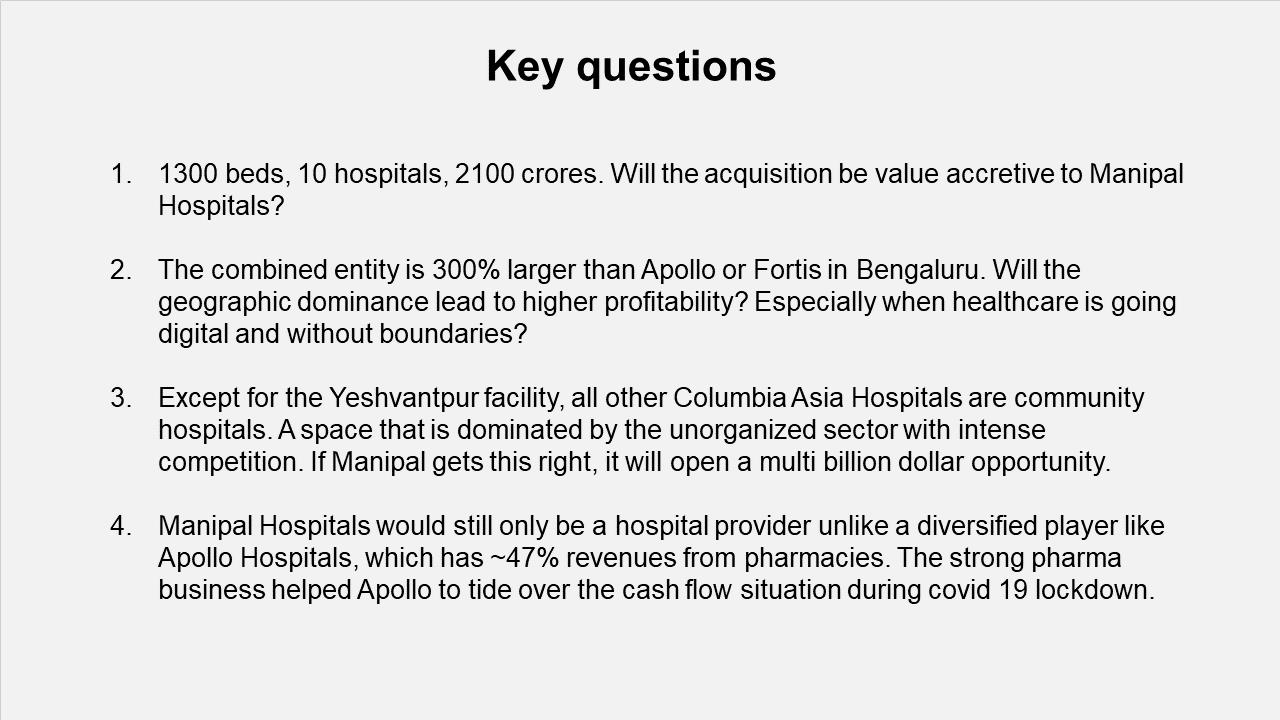

Manipal Hospitals is known for high end tertiary care services and derives a significant portion of their revenues and patient volume from cardiology, oncology, orthopedics, nephrology and emergency care. While for Columbia Asia, the model has always been community care that provides secondary care services. Except for the Yeshwantpur facility of Columbia Asia, which is a multi speciality facility and is strong in transplants, all other facilities are mostly community based facilities. This market though significantly larger than tertiary care services also has significant competition from the unorganized sector and doctor led practices.

With a reported deal value of approximately Rs. 2,100 Cr, the acquisition cost per bed is estimated to be Rs. 1.6 Cr. This valuation is approximately 60-70% higher than the replacement cost of a hospital bed.

This suggests that Columbia Asia’s valuation incorporates synergistic growth opportunities and access to new markets.