We worked with one of the largest hospital chains in India and advised them on the acquisition of another top 10 hospital chain, given the opportunity for healthcare consolidation in India. Camomile carried out a clinical, infrastructural and operational assessment to come with recommendations including fair value and risk mitigation plans.

A US $200 Bn diversified investment firm whose investments are guided by four key themes – transforming economies, growing middle income populations, deepening comparative advantages and emerging champions.

On an average, the company has invested more than US $1 Bn every year in India across sectors such as consumer, financial services, new economy, healthcare and pharmaceuticals.

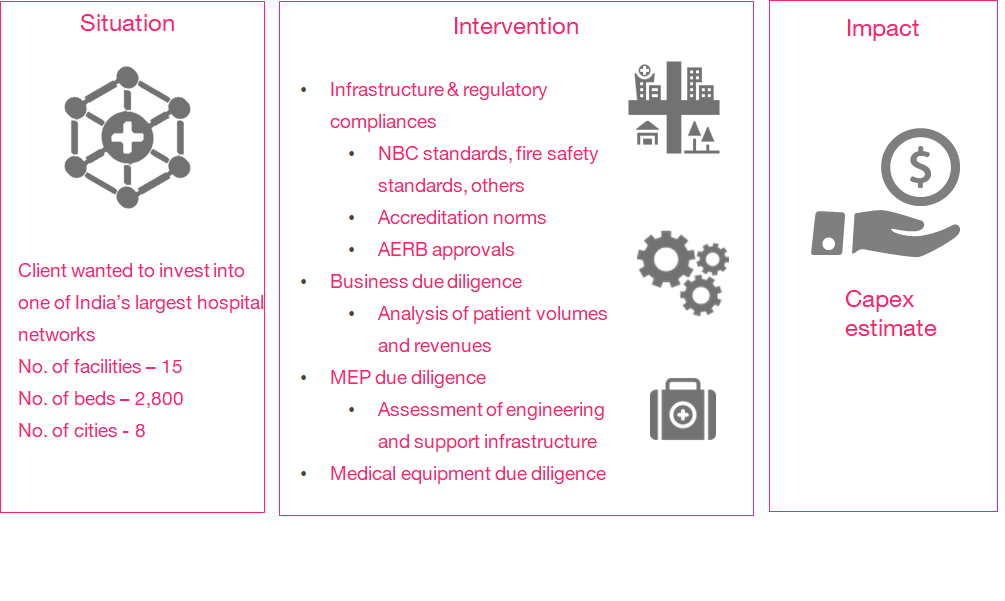

The firm sought investment options in the healthcare ecosystem of India and identified an opportunity to acquire a majority stake in one of the largest hospital groups in the country. The target hospital had 15 unique facilities with a capacity of 2800 beds.

To understand the fair value of the asset, the firm needed the hospitals to be reviewed comprehensively and estimate the business potential and the capital required to be invested to comply with best-in-class standards. Camomile’s senior healthcare consultants were appointed for this exercise.

Camomile formed a multi-functional team of experts consisting of hospital finance specialists, architects, engineering services specialists, equipment specialists and others. We undertook a comprehensive due diligence exercise to assess more than 15 facilities in the hospital network.

Detailed information collection templates were created and shared with hospital management prior to the visit. the focus areas included the following,

In addition to the above, patient safety and hospital compliances were one of the key focus areas. All compliances related to national and state level regulations were studied and corrective interventions as required were suggested. This included infrastructure related approvals, clinical practice approvals, equipment related approvals and land and building related compliances.

The overall assessment of the entire hospital network was done. All departments were rated and benchmarked against industry standards. All facilities in need of interventions were highlighted in the project report.

The key insights from the facility visits and the data collected from the hospitals were used to estimate the capex requirement for upgradation of the hospitals. The following were the key deliverables submitted:

The above insights enabled the clients to estimate the fair value of the asset and proceed with the investment.

#hospitalduediligence #hospitalreview #hospitalvaluation #healthcareinvestment

Ready to talk?